Kryptovalutor som bitcoin fortsätter att dominera bland börshandlade fonder i Europa, även under april 2021. Men fonder med fokus på ”mjuka” råvaror som majs, sojabönor och socker finns också med bland vinnarna.

Bland förlorarna dominerar också nischade fonder, men istället inriktade på investeringar i cannabis, väte och nya energikällor. Enligt Morningstars data var det förra månaden 183 procentenheter skillnad mellan de bästa och sämst presterande europeiska börshandlade produkterna (ETP), för de levererade avkastning under april mellan +173% och -10%.

The Leaders

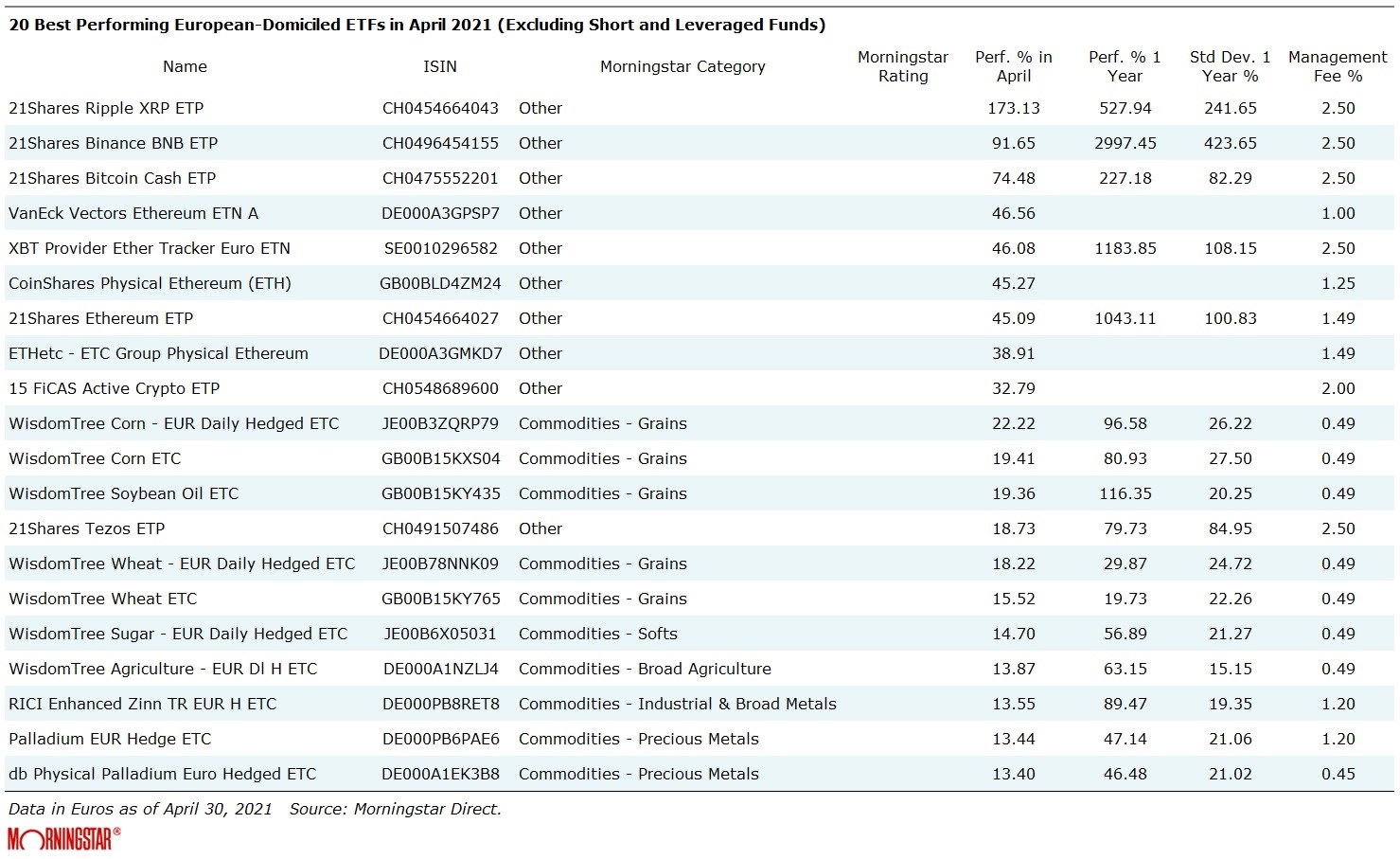

Cryptocurrencies have been on the rise for years, but the past several months have been the most exciting for cryptos enthusiasts.

The best performing ETF in April was the 21Shares Ripple XRP ETP (AXRP) showing a total return of 173% last month. Behind this rebound there is a legal saga which is arguably driving the price higher - investors in the coin are hoping that the US Securities and Exchange Commission backs down following its ruling that XRP is an unregistered security.

In second place there is the 21Shares Binance BNB ETP (ABNB) which gained over the last year an outstanding 2,997%. Such gains can be tempting to new investors, but it is always wise to remember that what goes up can go down very quickly (especially in the world of crypto). A good parameter to measure of the volatility of such instruments is the standard deviation, which shows how an investment has exceeded or lagged the average performance. For example the 21Shares Binance BNB ETP shows 423 points of standard deviation over the last year, meanwhile a tracker following the S&P 500 index has typically a standard deviation of 12 points in the same period. (Morningstar analyst Amy Arnott has looked in detail at Bitcoin and volatility in this article).

Among the cryptos in the top performers table there are several ETCs exposed to soft commodities such as corn, soybean, wheat, and sugar. This is part of a broad rally for agricultural commodities that’s stoking inflation fears. In particular, corn prices hit a nearly 8-year high on April 25; there are several drivers behind the move for maize, including strong demand from China.

Finally, the surge in palladium’s price continued. The metal is used in catalytic converters to reduce harmful emissions, and tightening environmental regulation is forcing auto makers to put more into each vehicle.

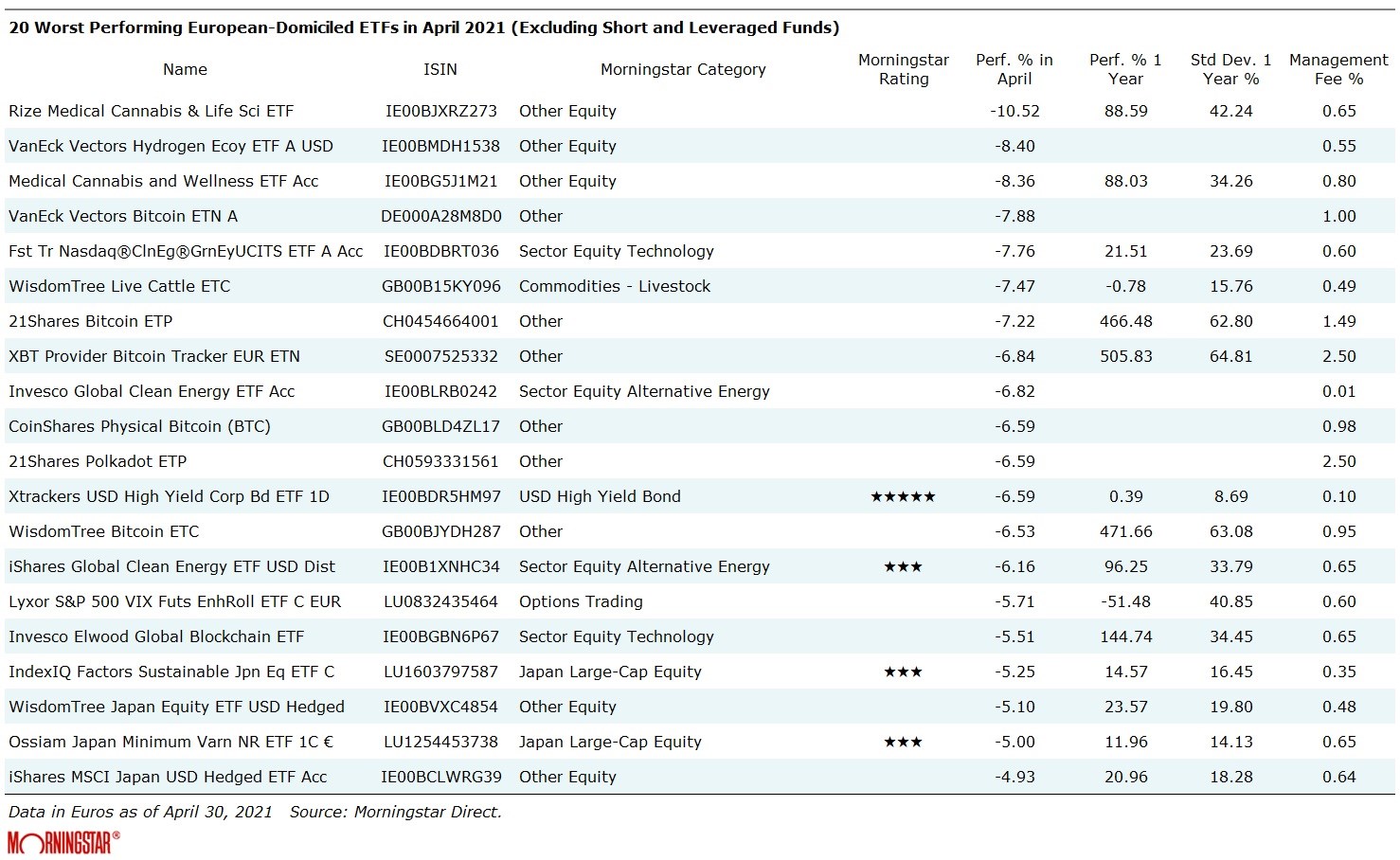

The Laggards

Equity markets continued to post further gains last month, but it was not kind to all segments of the market. Some thematic plays posted significant losses: the worst performing ETP in Europe last month was the Rize Medical Cannabis & Life Sci ETF (FLWG). In third position there is another tracker exposed to the cannabis business, the Medical Cannabis and Wellness UCITS ETF (CBDP). Having said that, both ETFs are still up 20% year to date even after a subpar April.

In second place from the bottom is another thematic tracker, the VanEck Vectors Hydrogen Economy UCITS ETF (HDRO), a new offering launched at the end of March. HDRO tracks the MVIS Global Hydrogen index which offers exposure to companies in the global hydrogen economy such as producers, fuel cell manufacturers or companies in the electrolysis sector.

Bitcoin, for its part, saw its value dropping from $63,346 (a fresh record high) to $48,543 in only 10 days (from April 16 to April 26) and posting its biggest one-day drop in almost two months. Warnings that novice investors could suffer heavy losses from speculating in crypto assets and Turkey’s central bank decision to ban the use of cryptocurrencies and crypto assets for purchases, might be behind the selling. Despite its recent turbulence, though, Bitcoin is still up 510% over the past year. Inflation and central bank policies have arguably been its biggest drivers during the past 12 months.

Japan equity ETFs also had a negative month, with a fall in the index spurred by changes to central bank equity buying, weak earnings reports and a rise in coronavirus infections. This underperformance of ETFs was mirrored by Japan open-ended funds, which were among the weakest performers in April.

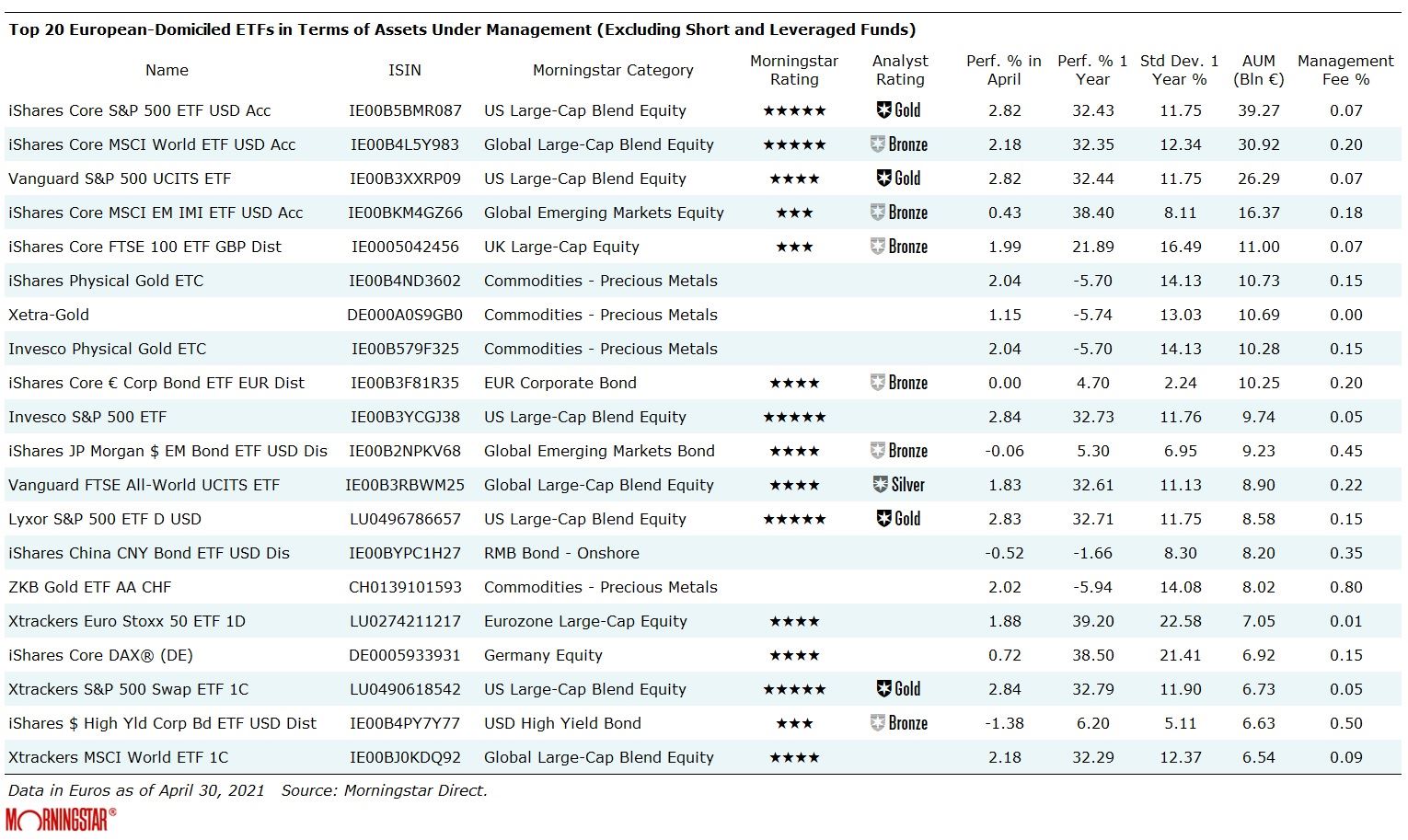

The Biggest

Monthly top and bottom performers often coincide with very volatile and therefore risky products, which should play a satellite role in your portfolio. Above you have an overview of the biggest European-domiciled ETPs in terms of assets, which could be more appropriate to consider among core holdings. Monthly performances go from 2.8% of the Lyxor S&P 500 UCITS ETF (LSPU)down to iShares $ High Yield Corp Bond UCITS ETF USD (IHYU), which lost 1.4% in the month.